(Duke Ellington in formal garb around the time he invented a new world. Photo courtesy Ellington Estate.)

Day One back from the Front Range of the Rockies was in the bag. I was eager to have a glass of crisp Willow White and talk about the remarkable things that had occurred that morning. At least I thought it was remarkable, though I did not know for sure. I wanted to hear what the usual suspects thought about it, and see if my pal The Marine had some thoughts about who the next SECDEF was going to be, once Mr. Gates takes his exit this summer. I was whistling as I went.

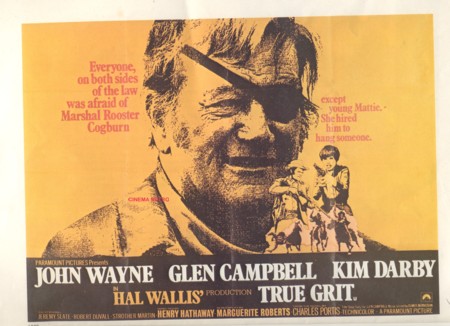

I am a big fan of The Duke. Well, both of them, in the right moment, if you know what I mean. I liked the old movie version of “True Grit” better than the new one, though after a re-read of the original book by Charles Portis, I imagine the Cohen Brothers casting Jeff Bridges as Marshall Rooster Cogburn is closer to what Mr. Portis was getting at than The Duke did years ago, but, well, you know.

“Fill your hands, you Son of a bitch!” said the way Mr. Wayne said it still resonates in my head after all these years, even if it was bold talk for a one-eyed fat man.

(Lobby Poster for the 1969 film version of True Grit.)

Author Portis cast his tale in an antique language takes a few minutes to get used to, sort of like the Great Weasel-Sphinx of the Fed, Allan Greenspan. And that is precisely why I was channeling the immortal other Duke, Mr. Ellington, as I walked toward Willow whistling “It don’t mean a thing (if it ain’t got that swing). The Duke wrote the music, lyrics by Irving Mills (aka Joe Primrose) when he was doing repeat gigs at the Little Tavern in Chicago. The title was based on the life philosophy of former session-man Bubber Miley, who was then dying of tuberculosis.

(Architect of Swing Bubber Miley.)

Bubber was the master of the plunger mute. His growling, drunken trumpet sound was largely responsible for the Duke’s initial success in the 1920s, but Bubber had his demons and a life-long affair with the bottle and the Duke had to shit-can him two years before the song was written. The upward climb to national prominence for the Duke, a consummate professional, and the eclipse of Miley, a committed drunk, coincided with the disintegration of the financial system.

His spirit was indomitable, even if the flesh was week. You could say that the title inspired the Age of Swing, which coexisted, or had to be invented, to accommodate the ravages of the Great Depression.

I have mentioned before that those bastards at Goldman-Sachs were responsible for that one, too, haven’t I? I had to think about that after the first meeting of the week when the clock radio on my desk told me that it was back to business as usual for the band of thieves who drove us to the brink of bankruptcy.

(John Walsh, Acting Comptroller of the Currency. Official US government photo.)

John Walsh, the Acting head of the Office of the Comptroller of the Currency, announced the he had reached a negotiated settlement with the gang of 14 banks that handle the vast majority of mortgage paper. In the decree, he said he was imposing “enforcement actions” against the thieves that actually a slap on the wrist.

Rather than do his job and enforce the law, the bank regulators are instead requiring the banks to hire their own “consultant” to review their foreclosure practices and then develop a plan for how to comply with the law. Jesus!

It is mind boggling, like telling muggers to go hire their own judge. What it actually does is impose the doctrine of pre-emption which holds the Federal agreement supreme against the legislative authority of the States, pre-empts a joint effort by the 50 State’s Attorney Generals to actually drag the scumbags into court.

Crap! I was mulling that, and a contract modification, when another thunderbolt was emitted from the little speaker on the radio. The famous rating concern Standard & Poors issued a negative outlook on the value of US Treasury Securities.

“Finally,” I thought. “It is confirmation of what Bill Gross did last month. He took his Pacific Investment Management Company completely out of government-related securities.”

Much later, I could not get The Duke’s tune out of my head. After dodging traffic on Fairfax Drive to Willow, I plunged into the cool darkness and plopped down at my usual stool at the L of the bar between The Marine and Old Jim.

“So what do you think?” I asked. “I mean, is it starting already? The President says the downgrade is a political act, part of the budget battle between the Ryan Budget and his campaign plan.”

“Politics in Washington?” said Jim, snorting into his Budweiser. “Nah. Not here.”

“No, really,” I said, waving to the lovely Elisabeth-with-an-S and John-with-an-H, who was procuring one of Willow’s delicious deserts for his mother, who was matching it with a highball.

The Marine said: “It don’t mean a thing. S&P has only been doing this crap since 1989, and none of the five AAA-rated sovereign nations they have issued concerns about have defaulted. Two of them- including Britain- have bounced back on the assessment to a positive ratings.”

“It is still a one-in-three chance of default,” I said. “That is huge.”

Jim cleared his throat as two of my associates arrived to flank us all. “It is bullshit.”

“No sovereign nation ever has to default,” agreed Harry, who anchored himself on the window side of Jim. “If they have their own currency, they can just print their way out of it. That was the problem in Greece. They could not print Euros and lost their wiggle room and had to be bailed out by the Central Bank.”

“But doesn’t that mean inflation will accelerate wildly to keep up?”

“It hasn’t worked that way in Japan,” said the statuesque blonde who runs all our business affairs. “They are still in a deflationary spiral after a decade of printing yen.”

“And besides,” said the Marine, “S&P are the idiots who missed the greatest financial collapse in history. Oh, hell, they helped cause it by rating those junk mortgage backed securities as Triple AAA investments. They are just posturing to show how independent they are. Creeps.”

‘Wall Street was down one percent at the close,” I said. “Heard it just as I was leaving the office. The market seems to think that Treasury yields will directly affect rates on consumer loans, particularly mortgages.”

“The cost of issuing new debt will definitely increase,” said Jim with concern, “and that will eventually be reflected in higher Budweiser costs. This is serious.”

“The people at NPR were saying as I left the office that it could mean a 6 to 6.5 percent decline in American stocks over the next three months,” I said grimly. “My 401k just got back to positive performance over the last four years. Fuck.”

“We do have a long-run debt problem, said The Blonde. “This is a tool to increase the pressure on politicians to take action. The forecast is about a crisis in 2013, not tomorrow. We have the time to take on the fat cats. We need to find equitable solution.”

“The 2013 thing is pretty significant,” said The Marine, taking a sip of his martini and glancing at his watch. “It will place this all beyond the next election. And S&P have demonstrated they have their heads up their asses.”

“So the downgrade doesn’t mean a thing?”

“Not at the moment. There is no Republican that has a hope in hell of beating him in a one-to-one showdown. Donald Trump? Sarah Palin? Newt Gingrich? Plastic Romney? Come on. They are a cast of clowns,” I said.

“The President can say he has a Secret Plan to reduce the debt, like Nixon’s secret plan to end the Vietnam War.”

“There could be a game changer in the equation,” said Jim. “Suppose a bona-fide national hero shows up.”

“Like who?” I said skeptically.

The Marine smiled. “Suppose General Patreaus isn’t interested in being Director of the CIA? Suppose he sits this immediate flail out, retires and jumps into the race as the Republican answer to spend and tax Obama?”

“Jesus,” I said. “Dave is no Ike.”

“True,” said The Blonde, “but he could be a man on horseback.”

The Marine called down the bar for his check. “He is an ambitious son-of-a-bitch, that is for sure.”

“Yeah,” said Jim. “So it don’t mean a thing. There is a song about that.”

“The Duke did it. If it don’t swing, it don’t matter.”

Jim took a long draw on his Bud. “And when the Treasury gets in a jam, it is going to be because of a panic in the market anyway, when everyone realizes we have hit a tipping point. Not because of those boneheads at S&P.”

I took a sip of Willow White and wondered what that was going to be like. 2013? Damn. We never did figure out who was going to be SECDEF.

(General David Patraeus. Official US Army Photo.)

Copyright 2011 Vic Socotra

www.vicsocotra.com